Small business owners have a lot of responsibility. While it can seem like enough to keep up with managing day-to-day operations, it’s important to have a long-term view. Growing a business takes money, and that requires building up your business credit and, in many cases, taking steps to improve your business credit score.

If you’ve ever struggled to build and maintain a good business credit score, you’re not alone. Thirty-six percent of small business borrowers are turned down for financing due to insufficient credit history, and 27 percent are turned down due to low scores, according to a Federal Reserve survey. Fortunately, there are still lending options available for those with bad credit. Your long-term plan, however, should be to improve your score, opening doors for broader lending options down the road.

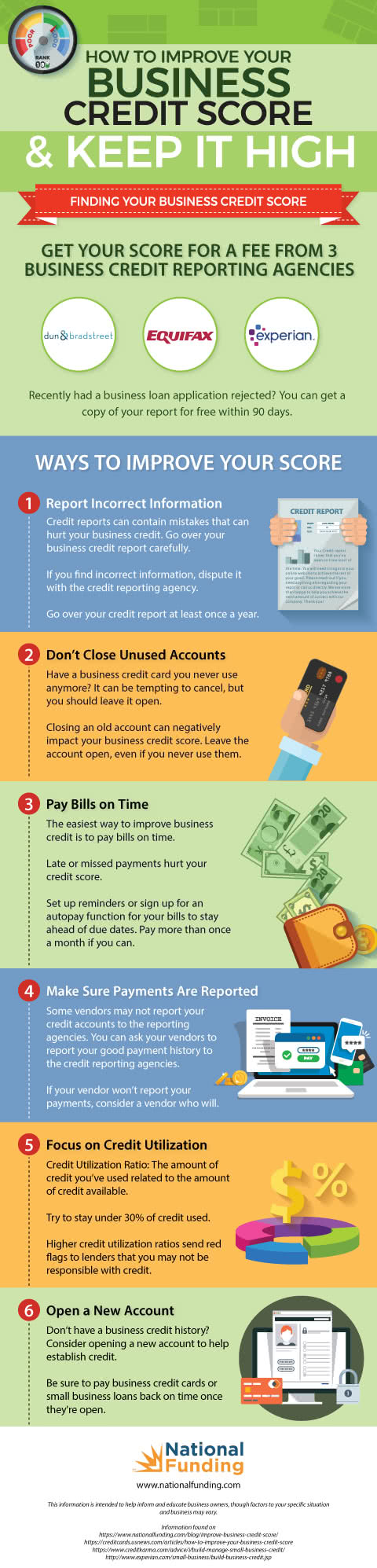

How to Improve Your Business Credit Score

Start by understanding the difference between your personal and business credit scores. The Federal Reserve reports that 37 percent of lenders review both scores, while 50 percent rely on the owner’s personal credit score and 13 percent rely on their business score.

You’re probably familiar with your personal credit score, assigned by credit reporting agencies such as Equifax, Experian and TransUnion. It’s based on your personal debt experiences, including your payment history, outstanding balances and the length of credit. It ranges from 300 to 850, with a higher score being better.

Your business credit score, on the other hand, represents the strength of your business as a candidate for a loan. It’s based on your company’s financial history and is calculated by looking at your payment history with vendors, suppliers and lenders. This score ranges from 0 to 100, and the higher the number the better.

In a Manta and Nav survey, 72 percent of small business owner respondents said they don’t know their business credit score and almost 60 percent don’t know where to find it. Getting this information is the first step to improve your business credit score. You can obtain your score for a fee from the business credit reporting agencies, Dun & Bradstreet, Equifax and Experian. Your score can vary depending on the agency; each calculates it differently. If you were denied a business loan due to information the lender found on your business credit report, you can get a copy of the report for free by making a request within 90 days.

If you obtain your score and it’s low, don’t fret. There are a number of steps you can take to improve it.

1. Report Any Wrong Information

Start by closely reviewing the reports, looking for inaccurate information. If you see anything on your report that’s wrong, such as an unpaid debt that you did pay, call the credit reporting agency and dispute it. The lender then has 30 days to verify the information in your file or it will be removed. This is a critical first step for improving your score.

2. Keep Unused Accounts Open

If you notice old accounts you no longer use while reviewing your report, it may be tempting to cancel them. Don’t do that. Closing unused or old accounts can actually have a negative impact on your credit score. Let them sit open.

3. Pay Your Bills On Time

The next step is also the easiest: start paying your bills on time. While this advice sounds like a no-brainer, it’s not uncommon to get busy with your day-to-day responsibilities and let bookkeeping tasks fall through the cracks. Establish a good system, and be diligent about timeliness. Late payments hurt your score. Pay at least once a month, or make more frequent payments if you’re able.

4. Ask Vendors to Report Payments

As you review your score, look for any vendors or suppliers that are missing. Not all B2B lenders report credit history as it’s not a requirement. If you have accounts with vendors and suppliers where you’ve established a good payment history, ask them to make reports or increase the number of positive payments to your file, especially with Dun & Bradstreet, the largest business credit bureau. This can help improve your business credit score. If the vendor won’t report your payments, consider opening accounts with other vendors that will. The more positive reports you have from vendors or suppliers, the better your business credit rating.

5. Balance Your Credit Utilization Ratio

Pay attention to your credit utilization ratios, which is one of the factors credit reporting agencies look at when assigning your score. This ratio measures the amount of credit used in relation to the amount of credit available. A good rule of thumb is to keep your ratio under 30 percent, notes Forbes. A high level of debt could indicate that your business is struggling to pay its bills. To achieve a good ratio, pay down balances, call your lender and ask that they increase your limit, or open another card or account.

6. Open a New Account

If you don’t have a lot of accounts in your business name, open one or two, such as a business loan or a business credit card. Having no credit isn’t much better than having bad credit, as lenders don’t have a history to review as they decide whether or not to approve your loan request. Make sure you repay any money you borrow or credit you use and choose lenders that won’t let you take out more money than you can afford to pay back. Having credit available that isn’t used is a positive to credit reporting agencies.

Maintaining a Good Business Credit Score

As you take steps to improve your credit score, make time to monitor your progress and learn how to protect your credit score. Check your credit reports at least once a year — more often is ideal — and look for errors. If you find a mistake, get it corrected as soon as possible by filing a dispute. More than one in five consumers have identified an error in their credit report, reports CNBC, and that can result in lenders offering you higher interest rates or denying credit altogether.

Having a good business credit score is an investment in the future of your business. Not only will you be able to get access to lower-interest loans, but you’ll also be able to negotiate better repayment terms from your suppliers because you’ve proven that you and your company are trustworthy. And having a good credit score may also help you attract new customers since anyone can access it.

While you are more than just a number, a credit score is a good reflection of the health of your business. Improve your business credit score to make sure it represents the story you want to tell the world for years to come.

See our handy infographic below to learn more about improving your business credit score:

If you’re in a cash flow crunch while building your business credit score, learn more about your financing options.