What’s the difference between long-term and short-term business loans?

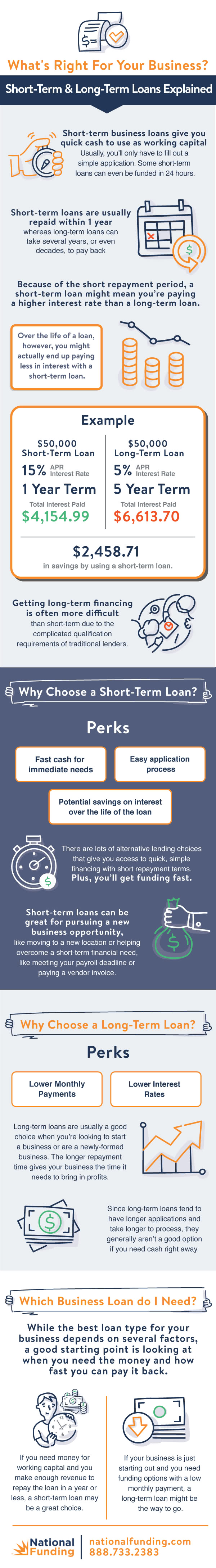

A long-term business loan involves multi-year repayment terms following a detailed application process. Short-term loans for businesses provide quick access to capital, sometimes in as little as 24 hours.

Whether it’s working capital or some other type of small business loan, the amount of money you need to borrow is probably your top priority when looking at loans. After all, if you don’t borrow enough, you’ll end up needing another loan. Borrow too much, and you may not be able to pay it back on time, regardless of it’s a long-term loan vs. short-term loan.

However, the length of your loan term should be one of the biggest factors you consider when shopping for a business loan.

Choosing between short-term loans and long-term loans can affect everything from how much money you can borrow to how much interest you’ll pay. Read on to learn the most important aspects of deciding between a short or long-term loan and check out our handy infographic to help you choose.

Short-Term Business Loans

For most business owners, a short-term loan is the way to go. A shorter loan term allows you to get the money you need quickly. You might even be able to be approved and have money in your account in as little as 24 hours. It’s almost impossible to find a long-term loan that can do the same.

Short-term loans also provide the right amount of money for business owners. You often need to ask for a sizable amount of money to receive a long-term loan. The lower amounts of a short-term loan make it easier to pay back the loan and get out of debt faster.

“Most times, small to medium-size businesses don’t need long-term financing,” said National Funding founder and CEO David Gilbert. “Alternative lending options, like working capital loans, or small-ticket equipment leasing, offer the flexibility and quick turnaround needed for owners to keep their businesses running smoothly.”

Essentially, short-term loans are an easier way for business owners to get liquidity and overcome financial setbacks, as opposed to taking on larger, more long-term debt.

Long-Term Business Loans

On the other hand, long-term loans may be necessary for some businesses. This type of financing involves multiyear repayment terms that can sometimes last for decades.

While short-term loans may have higher interest rates at first, business owners who take on long-term financing typically end up paying more in interest. The longer your loan has a balance, the longer you’re paying interest on the money you borrowed.

It’s also generally more difficult to be approved for long-term loans. Your lender will want to make sure they’re lending money to someone who can pay it back. Many long-term loans are also for larger amounts than short-term loans. This makes it riskier for the lender to give you the money.

A long-term loan is usually best for business owners looking to make a significant investment. For example, you’ll probably need a long-term loan to build a new office space from the ground up.

It’s usually not a good idea to take out a long-term loan for smaller amounts due to the cost of long-term interest charges.

Which is Best?

Ultimately, deciding between short-term vs. long-term loans comes down to the specific needs of your business. For most small business owners, a short-term loan will likely be more suitable. However, sometimes long-term financing may be necessary.

Regardless of the length of your loan, it’s important to work with a lender who understands the needs and challenges of your business. Try to find a lender who can customize a loan program to fit your needs, instead of putting your business into a one-size-fits-all box.

Still not sure if your business needs a long-term or short-term loan? Check out our infographic to help you choose.